Ethereum is a global, decentralised network of computers globally, adhering to predefined rules and functions. It serves as a platform for a plethora of applications, communities, organizations, and digital assets, and facilitates the seamless transfer of its native token, ETH.

To an extent it can be thought of as the base layer of a new digital economy.

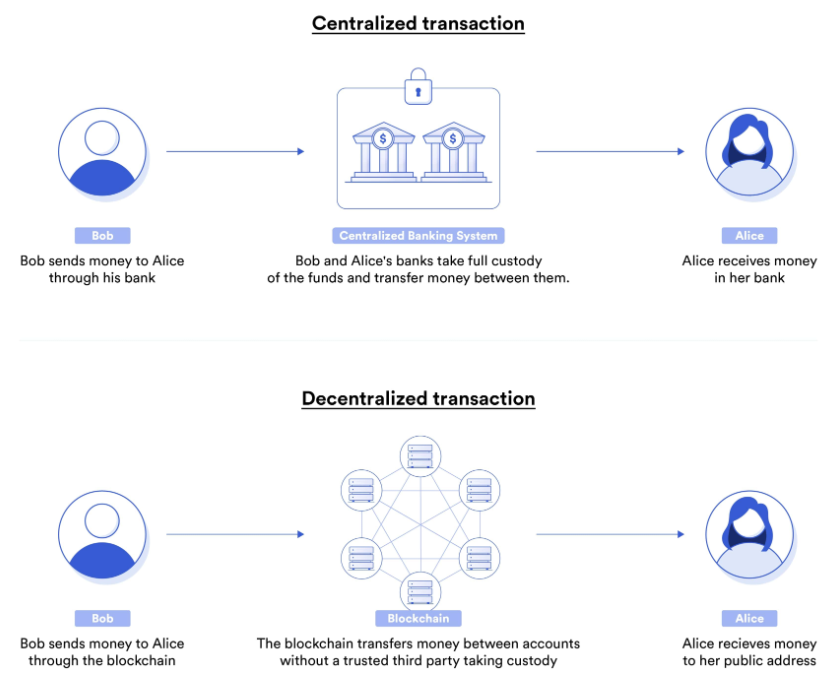

The revolutionary aspect lies in the network’s “trustless” nature. With “smart contracts”, users can engage in various activities without relying on any central authority or entity to control the network or dictate its rules. All these features and functions are powered by ETH, which is the currency used for network transactions.

In this article, we will delve into a comprehensive exploration of Ethereum and its profound significance within the industry.

We also weigh up the value proposition of ETH token.

Introduction

Ethereum is a blockchain network. It is a shared and secure database of transactions among computers within the network. Each time a batch of transactions is added, it forms a “block,” giving rise to the term “blockchain.”

Ethereum is a “Public” Blockchain, where data can only be added to the chain. Once recorded, it cannot be changed. It is what is known as immutable. Attempting to alter or manipulate the system would require owning the majority of computers in the network, an almost impossible task. This ensures one of the highest levels of security associated with Public Blockchains. Moreover, all that data is publicly accessible to anyone on the block explorer (etherscan.io).

Public blockchains, like Ethereum, are distinct from Private Blockchains, which, as the name implies, are private and controlled by a central authority. Access to a Private Blockchain is limited to select users. In addition to Public and Private Blockchains, there are two other types: Consortium Blockchains and Hybrid Blockchains. Each type serves distinct purposes and caters to specific use cases within the broader blockchain ecosystem.

When did Ethereum Launch? And Why?

Vitalik Buterin, a prominent cryptocurrency researcher and computer programmer, published Ethereum’s whitepaper in 2014. The project was officially launched on July 30, 2015, and had seven other co-founders: Charles Hoskinson, Gavin Wood, Amir Chetrit, Mihai Alisie, Anthony Di Iorio, Jeffrey Wilcke, and Joseph Lubin. Only Buterin remains fully committed to Ethereum, while the others have pursued individual ventures.

The primary motivation behind Ethereum was to build a decentralised platform that could go beyond the limitations of Bitcoin. While Bitcoin was primarily designed as a digital currency, Buterin envisioned a blockchain platform that could support more than just financial transactions. He wanted to create a decentralised ecosystem where developers could build and deploy smart contracts and decentralised applications (dApps).

Smart contracts are self-executing piece of code with predefined rules that automatically execute when specific conditions are met. They enable a wide range of applications, such as Decentralised Finance (DeFi) applications, Non-Fungible Tokens (NFTs), Supply Chain Management tools, Crypto Derivatives platforms and more.

Ethereum’s launch aimed to provide a unique and customizable blockchain that could empower developers to create innovative applications without relying on a central authority, or middleman. By offering a flexible and developer friendly environment, Ethereum became a foundation for a vast array of projects, solidifying its position as a major player in the blockchain and cryptocurrency space.

How Does Ethereum Work?

At the heart of Ethereum’s operation lies a consensus mechanism, which is a set of rules that allows the network to agree on the state of the blockchain and validate and verify transactions. The consensus mechanism of any blockchain is the fundamental foundation of its security.

Ethereum transitioned from a mining-based consensus mechanism (Proof of Work) to a staking-based mechanism (Proof of Stake) in September 2022.

Proof of Work (PoW) was popularized by Bitcoin and has been its consensus mechanism since its creation. However, PoW does have its drawbacks, particularly in terms of its high computational power and energy consumption. The process of mining, where miners compete to solve complex mathematical puzzles to validate transactions and add new blocks to the blockchain, demands substantial computational resources, which in turn consumes a considerable amount of electricity.

This energy consumption has raised concerns about the environmental impact of PoW-based cryptocurrencies like Bitcoin. This has led to negative publicity, with critics arguing that PoW mining contributes to carbon emissions and accelerates climate change.

As a result ofthese concerns, the Ethereum network shifted to a staking-based (PoS) consensus mechanism. In this system, validators lock up a certain amount of ETH as a stake to participate in block validation. Validators are randomly selected to propose and attest to new blocks based on the amount of ETH they have staked. The process is more energy-efficient and allows users to earn rewards by participating in staking.

However, there are some drawbacks and concerns about centralisation in Proof of Stake (PoS) consensus. One of the main concerns arises from the distribution of tokens among network participants. Generally, in PoS, block validators are chosen based on the number of tokens they hold and are willing to stake. This means that participants with a higher stake have more chances of being selected as validators and have a greater influence over the network’s decision-making process.

Source: Etherscan.io link Top wallets with ETH balance.

Nonetheless, the distribution of the ETH token is relatively widespread. The largest individual wallet holds 1.49 million ETH, which is a small fraction of the total 120 million ETH tokens in circulation.

I will talk more about ETH, the token, in a separate section below.

Ethereum’s Governance

Ethereum utilizes a decentralised governance model to make important decisions about the network’s future upgrades and changes. Anyone holding ETH can propose and vote on various improvement proposals, known as Ethereum Improvement Proposals (EIPs). This decentralised decision-making process ensures that the community has a say in the network’s development and evolution.

The project also has a non-profit organisation dedicated to supporting the development and growth of the Ethereum ecosystem, the Ethereum Foundation. It was established in 2014 and played a crucial role in funding early development efforts and coordinating the transition to Ethereum 2.0. The foundation continues to support research, development, and community initiatives that contribute to the advancement of Ethereum and its decentralised applications.

Ethereum Use Cases

Ethereum’s versatile and programmable nature has led to a diverse range of use cases that extend beyond basic digital currency transactions.

Source: Ethereum link Ethereum use cases

At its core, Ethereum functions as a peer-to-peer network, enabling direct interactions and transactions between individuals worldwide. By eliminating intermediaries and central authorities, it revolutionizes the way value is exchanged, empowering individuals to transact directly with each other. This decentralised approach not only fosters financial inclusivity but also paves the way for a more transparent and equitable digital economy.

Decentralised Finance / DeFi

Perhaps one of the most exciting and impactful use cases of Ethereum is DeFi, a groundbreaking movement that redefines banking and finance. DeFi platforms offer a plethora of services such as decentralised exchanges, and lending and borrowing applications. Without geographical barriers or exclusionary criteria, DeFi welcomes everyone, regardless of their location or financial status, to access modern financial tools and services with just a device connected to the internet.

DeFi enables the democratization of banking, placing financial empowerment in the hands of the masses.

Source: Chainlink link

Moreover, Ethereum’s programmable nature allows developers to create decentralised applications (dApps) that run on a trustless and censorship-resistant network. This transforms the internet into an open playground for innovation, where anyone can build, deploy, and access applications without relying on traditional web servers.

The possibilities are endless, from decentralised social networks to autonomous supply chain management, democratizing access to information and services.

ETH Token

ETH or Ether, Ethereum’s native token is an integral part of the overall Ethereum network. It fuels the ecosystem and acts as its backbone. In addition to acting as a digital store of value, ETH has many other use cases within the Ethereum Blockchain and wider ecosystem.

While it’s understandable that some individuals might be interested in blockchain technology but wary of cryptocurrencies, it’s essential to recognize why ETH is integral to Ethereum’s operation and has significant value associated to it:

Transaction Fees (Gas):

ETH serves as the currency for transaction fees (gas) on the Ethereum network. When users perform actions like transferring tokens, executing smart contracts, or interacting with dApps, they need to pay a small amount of ETH as a transaction fee. This fee, known as “gas,” compensates the network’s validators (miners in the past and stakers in the current Proof of Stake mechanism) for processing and verifying transactions.

Security and Protection against Cyber-Attacks (Staking):

ETH’s presence is essential for network security. With Proof of Stake, validators are required to lock up a certain amount of ETH as a stake. In return, they are chosen to propose and validate new blocks, and for doing so, validators earn rewards in the form of newly created ETH and a portion of the transaction fees on the Ethereum blockchain. The blockchain follows some predefined rules and regulation to automatically create new ETH based on the validator’s efforts, creating a fully decentralised system.

If a validator behaves dishonestly or attempts to attack the network, they risk losing their staked ETH as a penalty. This mechanism incentivizes validators to act honestly and protect the network from potential cyber-attacks, maintaining the blockchain’s integrity.

Smart Contract Execution:

Smart contracts, the cornerstone of Ethereum’s programmable capabilities, require ETH to execute on the network. Smart contract code must be processed by the network’s nodes, and the computational resources needed for execution are paid for with ETH. Without ETH, the execution of smart contracts would not be feasible, and the entire concept of decentralised applications and programmable money would not be possible.

Decentralised Governance:

ETH also plays a role in Ethereum’s decentralized governance. Changes and upgrades to the Ethereum protocol are proposed and voted on by holders of ETH. The more ETH one holds, the more voting power they have in shaping the future direction of the network. This democratic governance mechanism ensures that decisions are made collectively by the Ethereum community, rather than by a centralised entity.

Additional Utility:

ETH holders can put their tokens to work by lending them on lending platforms. By lending out their ETH, they can earn interest on their holdings, providing a way to generate passive income on their crypto assets. Additionally, ETH can be used as collateral to borrow other tokens, allowing users to access liquidity without selling their ETH holdings. Moreover, there are platforms which create “stablecoins” against ETH. [Stablecoins are a vital part of the crypto eco-system, as a synthetic means of holding digital dollars].

ETH Supply and Burning Details

ETH has a circulating supply of 120 million tokens, valued at $228bn. Out of that, around 21 million tokens worth $41bn are staked (locked). Moreover, after hitting a high of 122.3 million in circulation supply in September 2022, the supply has since been decreasing thanks to the EIP-1559 upgrade (see below). EIP-1559 was an “Ethereum Improvement Proposal” that changed the transaction fee structure. By introducing a base fee that is burned (destroyed), the overall ETH supply is able to be reduced.

Source: Glassnode

The reduction in supply addresses the issue of potential inflation, providing a deflationary effect that can act as a price support for ETH. As the network continues to gain adoption and usage, the demand for ETH for various purposes – such as staking, governance, and utility within DeFi applications – will also increase. The hope is that higher demand, against static or declining supply, will result in long term price appreciation.

Ali Shehriyar

If you have any specific questions or areas you’d like me to focus on, please feel free to reach out at the email above.