About us

Wiston Capital was established to professionalise investment in bitcoin and crypto assets.

Our core business is fund management, where we take an active, discretionary approach to portfolio construction.

We believe the adoption and ownership of bitcoin and digital assets will continue to expand as their use case becomes more apparent.

Through our free newsletter (CHAINLETTER) and educational events, we help investors improve their understanding of this new asset class.

CHAINLETTER sign-up

Our round-up of what’s happening in the world of crypto is free and it’s out once a fortnight. Fill in the form below, or subscribe on Substack.

You can see the latest edition of CHAINLETTER in the RESEARCH section below.

blog

Wars Cost (Other People’s) Money – CHAINLETTER 74

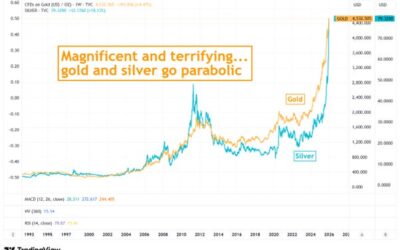

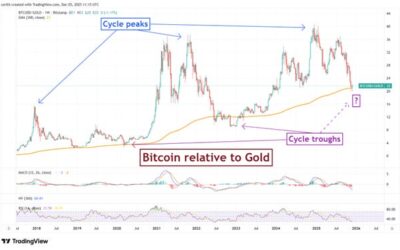

Bitcoin priced in gold has fallen further in this downcycle than in either of the previous two. In terms of the world’s oldest money, this is the worst crash in bitcoin’s history. It absolutely makes sense to de-risk a gold position by adding to BTC.

Life After Bitcoin – CHAINLETTER 73

Bitcoin started its journey as a form of money and has angled towards becoming a tech platform. Ethereum has moved precisely in the opposite direction. That could turn out to be a more interesting proposition.

The Future of Digital Assets

We have radically altered our view of bitcoin. Events and developments over the last eight months have highlighted fragilities that we once considered ephemeral. The next few months could be highly problematic. Details are in this note. All is far from lost for...

Bitcoin Isn’t Working

A discussion of why bitcoin's incorrect categorisation as "digital gold" is turning out to be highly problematic. The recent, sudden and unexpected underperformance of bitcoin, not just relative to the broad world of other financial assets but also against other...

Opportunity in Despair – CHAINLETTER 72

We reiterate our view that we are scraping the lows of this bitcoin cycle. Regulatory structures are being put in place for a tokenisation revolution, and the smashed up altcoin world is finally offering up some bargains. Wishing you a wonderful 2026. Technical: Gold...

Bitcoin Is Poised For A Bumper 2026 – CHAINLETTER 71

A look at what has held crypto back in 2025, and what propels it forward in 2026 Bitcoin peaked in November 2024…against gold We examine the main fears and opportunities for bitcoin Ethereum looks promising on a relative basis A year of altcoin catastrophe, but...

Crypto education

“Crypto Bootcamp”, our day-long course teaching the basics of blockchain technology and the evolution of money, continues to receive tremendous reviews:

- “Crypto is the future of investment. Understanding how crypto works is essential. This is a truly 5-star course delivered by practitioners, aimed at both high level professionals and enquiring retail investors.” Michael Howell, Crossborder Capital

-

“It was a fantastic and very interesting day. I learnt a lot about the crypto space, and came away enthused about what is to come and the opportunities ahead.” Luke Hyde-Smith, Co-Head of Multi Asset Strategies, Waverton Investment Management

Don't get left behind

The team

Charlie Erith

Founder, Senior Portfolio Manager

Charlie spent 25 years in institutional equity sales and fund management before embarking on a career in digital assets in 2020. He spent the first half of his career at Cazenove, working initially in the Asian offices, before becoming a Director of Institutional Sales in London. In 2006 he moved to Boyer Allan to manage a long/short Asian equity fund. In 2012, he co-founded Stone Drum Partners where he started a long-only fund with a focus on small and medium size Asian companies, which subsequently moved to Coupland Cardiff Asset Management in 2015.

Charlie started ByteTree Asset Management in 2020. As Chief Executive Officer he led the move into institutional investment management, launching both the AKJ Bitcoin & General Fund (2021) and the 21Shares ByteTree BOLD ETP (2022).

Wishing to concentrate exclusively on crypto fund management, Charlie founded Wiston Capital in June 2023 where he continues to manage the AKJ Bitcoin & General Fund.

William Ralston Saul

Head Of Strategy

William started his career in the mining industry, living and working in Tajikistan for 9 years. He co-founded his first mining company in 2006, which he sold in 2013.

William first took an interest in blockchain in 2017. After several years becoming increasingly involved in the space, he decided that comprehensive education was one of the key missing ingredients. In 2020 William co-founded the InCrypto Hub education platform to address this issue.

In 2022 William became the CEO of Jade Vault Ltd. This is the world’s largest Jadeite gemstone deposit which will also incorporate Jade City, the world’s first blockchain powered Jadeite trading platform.

Shehriyar Ali

Senior Research Analyst

Ali has been working in the realm of crypto asset research and analysis since 2021. He has authored multiple research articles, and co-manages the DigitalVision strategy with Jake Anderson.

His keen interest in the crypto space led him to specialize in onchain network analysis, delving into the intricate workings of blockchain networks to gain valuable insights into their operations. Furthermore, his deep understanding of tokenomics design has enabled him to unravel the complexities of the economics of a crypto project, providing valuable perspectives on the dynamics of digital assets.

Ali holds an honours degree in International Business from Teesside University. Hailing from Hyderabad, India, Ali lived in Singapore for 3 years before moving to Adelaide, Australia. Ali is currently studying for a Masters In Finance.

Jake Anderson

Assistant Portfolio Manager

Jake joined Wiston Capital full time in January 2025, and co-manages the DigitalVision strategy.

Jake has a background in the financial advice sector and brings an understanding of both traditional and decentralised finance. He has been an investor in crypto assets and blockchain technology since 2021, conducting extensive independent research into the real-world applications of projects, with particular interest in emerging trends. He has a keen interest in the transformative power of the space for emerging markets and ESG-friendly projects as well as the emerging AI sector.

Jake holds a First Class degree in Economics from Swansea University and is based in London, UK.

Our contact details

Fund Management enquiries: [email protected]

General enquiries: [email protected]

Media: [email protected]

Wiston Capital Ltd (Company no. 14953453), 22 Friars Street, Sudbury, CO10 2AA, UK