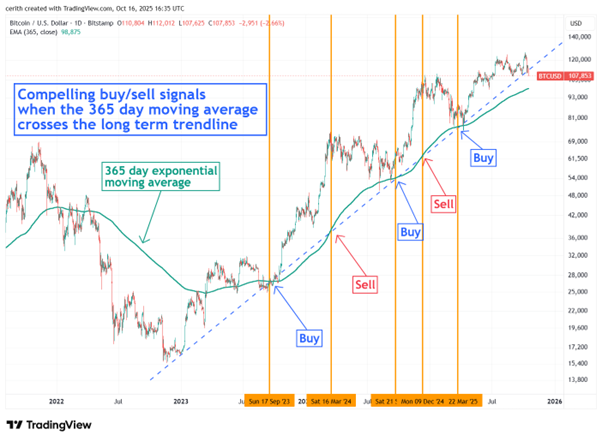

There’s a strong two-way pull in the bitcoin market at the moment. For those wanting long term capital appreciation, however, these are the rare moments to get involved.

The technical picture tells us that a lot of caution has already been built into the price. Contrarian signals are flashing green and that’s normally a good time to be buying. On the flipside, asset markets more generally still look complacent, just as we see cracks starting to appear in the liquidity story.

For those wanting to invest in bitcoin for the long term, this is a great moment to get started. For those trading short term: be careful, and minimise the use of leverage.

- Technical Damage from the “flash crash” takes us into long term buying territory / contrarian signals abound, including collapsing DATs / time to switch from gold to BTC / no more bitcoin cycles / Fartcoin: the joke is over

- On Chain A cup of coffee please, I’ll pay in bitcoin – poor fee generation means still in accumulation phase

- Macro Grim Repo – cracks appearing across risk assets, so be careful – but any violent drop would catalyse an almighty rally