You Can Have Bitcoin ETNs, But You Can’t – CHAINLETTER 67

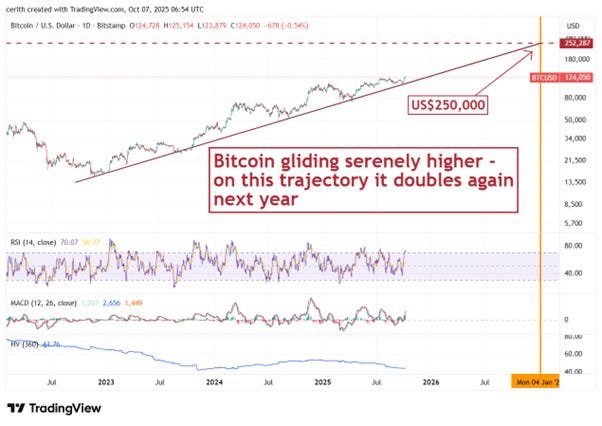

On the 5th anniversary of the original banning of bitcoin ETFs in the UK, and despite the promises, it seems we’ve hardly advanced at all. Technical Bitcoin gently grinds higher to a new high. US$650,000 bitcoin fair valuation as volatility remains subdued. Macro You...

Bitcoin US$650,000 – CHAINLETTER 66

A look at bitcoin valuation through the lens of inverse volatility. A look at the Inverse Volatility of bitcoin and gold suggests to us that in relative terms bitcoin is massively undervalued. With gold at US$3,881/oz, bitcoin should be around US$650,000, a five-fold increase from here. Even if you disagree with the detail, that’s a huge margin of safety. Take a look at the calculations and let us know what you think.

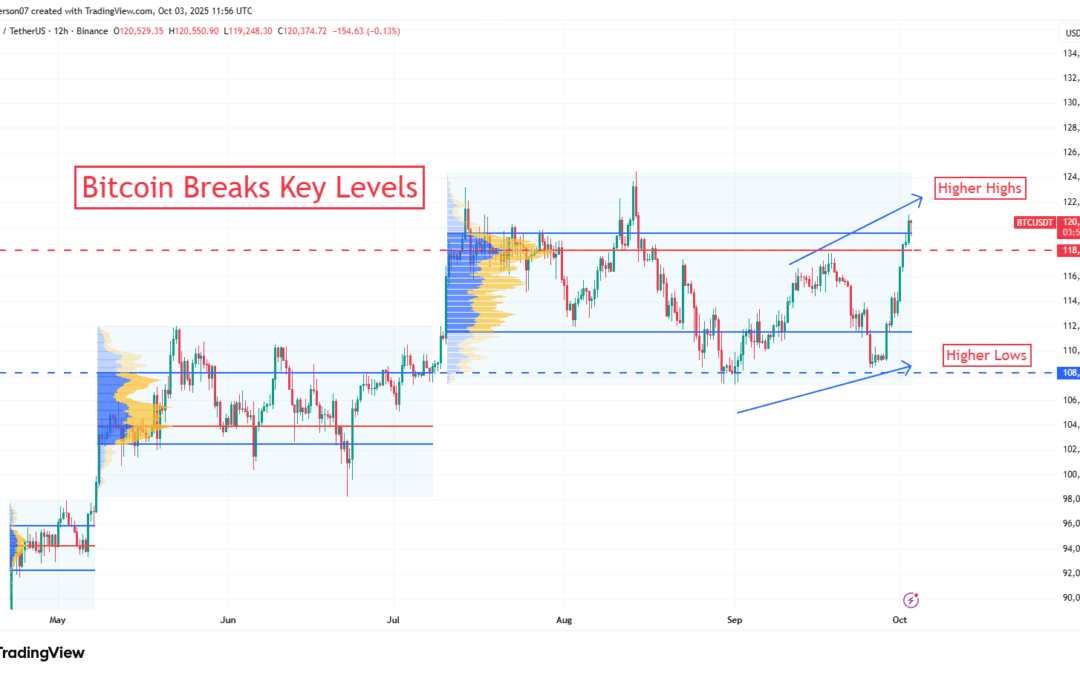

Crypto Consolidates as Macro Clouds Loom

Check out the latest edition of Chainletter, where we cover: Technical: bitcoin solid in a range, gold breaks out, Ethereum’s key test On-Chain: Ethereum mainnet strength, Layer 2s assistance Macro: rising debt and falling liquidity, inflation latest Decentralised...

Too Quiet Out There – CHAINLETTER 63

In the short term there are a couple of things that urge us to tactically rein in our bullishness, not least that there is so much complacency in markets, at least as defined by volatility. Furthermore, the dollar has just sharply strengthened – should we be nervous about liquidity conditions?