Research archive

The Future of Digital Assets

We have radically altered our view of bitcoin. Events and developments over the last eight months have highlighted fragilities that we once considered ephemeral. The next few months could be highly problematic. Details are in this note. All is far from lost for...

Bitcoin Isn’t Working

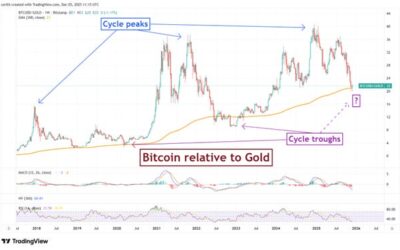

A discussion of why bitcoin's incorrect categorisation as "digital gold" is turning out to be highly problematic. The recent, sudden and unexpected underperformance of bitcoin, not just relative to the broad world of other financial assets but also against other...

Opportunity in Despair – CHAINLETTER 72

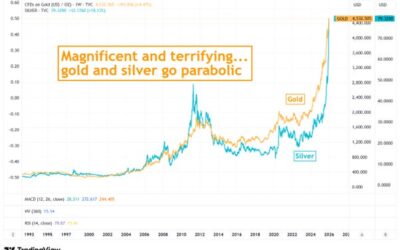

We reiterate our view that we are scraping the lows of this bitcoin cycle. Regulatory structures are being put in place for a tokenisation revolution, and the smashed up altcoin world is finally offering up some bargains. Wishing you a wonderful 2026. Technical: Gold...

Bitcoin Is Poised For A Bumper 2026 – CHAINLETTER 71

A look at what has held crypto back in 2025, and what propels it forward in 2026 Bitcoin peaked in November 2024…against gold We examine the main fears and opportunities for bitcoin Ethereum looks promising on a relative basis A year of altcoin catastrophe, but...

Bitcoin’s Moment of Weakness – CHAINLETTER 70

After a disappointing year for bitcoin we’re at a point where to be a buyer you need conviction in the long term story. Traders are heading for the door. We utterly retain that conviction. But we’re conscious that we have to unravel the reasons behind the recent...

The AWS Outage: A Wake-Up Call for Digital Resilience

In this note, we consider the impact of the recent AWS outage and what it revealed about the balance between resilience and reliance in the digital age. Some parts of crypto held firm, while others faltered, offering a useful snapshot of how far the sector has come,...

Bitcoin Is A Long Term Buy – Chainletter 68

There’s a strong two-way pull in the bitcoin market at the moment. For those wanting long term capital appreciation, however, these are the rare moments to get involved. The technical picture tells us that a lot of caution has already been built into the price....

Crypto Crumble

Last night the bottom fell out of the crypto market. The trigger seems to have be a renewed round of punitive trade tariffs imposed by Donald Trump on China. Read our initial...

You Can Have Bitcoin ETNs, But You Can’t – CHAINLETTER 67

On the 5th anniversary of the original banning of bitcoin ETFs in the UK, and despite the promises, it seems we’ve hardly advanced at all. Technical Bitcoin gently grinds higher to a new high. US$650,000 bitcoin fair valuation as volatility remains subdued. Macro You...

Binance – The Everything Ecosystem

Executive Summary BNB, the native token of BNB Chain, has reinforced its position as one of the top-performing assets in crypto, reaching an all-time high of $1,210 on October 6th, 2025 with a fully diluted market cap of US$168.6 billion. Its growth is underpinned by...

Bitcoin US$650,000 – CHAINLETTER 66

A look at bitcoin valuation through the lens of inverse volatility. A look at the Inverse Volatility of bitcoin and gold suggests to us that in relative terms bitcoin is massively undervalued. With gold at US$3,881/oz, bitcoin should be around US$650,000, a five-fold increase from here. Even if you disagree with the detail, that’s a huge margin of safety. Take a look at the calculations and let us know what you think.

Crypto Consolidates as Macro Clouds Loom

Check out the latest edition of Chainletter, where we cover: Technical: bitcoin solid in a range, gold breaks out, Ethereum’s key test On-Chain: Ethereum mainnet strength, Layer 2s assistance Macro: rising debt and falling liquidity, inflation latest Decentralised...