Research archive

Tron – Stablecoin Powerhouse Under Pressure

Tron looks to navigate this high-growth sector as new challenges arise in 2025. We remain impressed by the evolution of Tron as a stablecoin leader. Its track record is solid but could be under threat. In this note, Jake and Ali take a detailed look at this stablecoin...

Is Ethereum Money?

The debate will go some way to determining whether this rally continues In this note we will examine why ETH has underperformed BTC, what has changed and what the path forward might look like. We ask what constitutes “money” and consider whether ETH has the...

Too Quiet Out There – CHAINLETTER 63

In the short term there are a couple of things that urge us to tactically rein in our bullishness, not least that there is so much complacency in markets, at least as defined by volatility. Furthermore, the dollar has just sharply strengthened – should we be nervous about liquidity conditions?

Higher Price, Lower Volatility – CHAINLETTER 62

As predicted in the last edition, bitcoin has broken to a new high. The volcano erupted once again. For good reason: new regulation in the USA will enable wealth management and traditional finance to engage and invest in this new asset class. The importance of this...

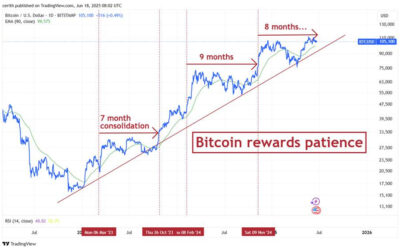

The Bitcoin Volcano Is About To Blow…Again – CHAINLETTER 61

We’re getting to the end of a consolidation period that is similar to previous episodes in the current bitcoin bull market.

Bitcoin Holds Firm In A Nervous World – CHAINLETTER 60

It’s a nervy time in the crypto sphere, against an unsettled global political backdrop. We wonder whether regime change would deliver a path to reconciliation between China and Taiwan, and so imbue the former with the global respect to complement its size and...

Is Bitcoin Evil? – CHAINLETTER 59

Having long been dismissed as an irrelevant joke, bitcoin is getting a better hearing, but in many professional investment circles it remains grudging. What stage of acceptance are we at?

The Pause That Refreshes – CHAINLETTER 58

There are times to charge, and times to pull in one’s horns. We’re going through the latter stage at the moment. However, a pause for breath is healthy in a bull market. “Back and fill”, as they say.

The Great Repricing Begins – Digital Vision 18

Retail is getting smarter, America is charging ahead, and Maple hits $1B on-chain Last week, we flagged what could be a key moment in this cycle: crypto finally starting to break away from its old correlation with tech stocks. We covered it in more detail in our...

Bitcoin Is No Longer A Tech Stock – CHAINLETTER 55

It’s a fascinating, troubling, but ultimately extremely bullish moment for the crypto world.

The Signal We’ve Been Waiting For – Digital Vision 17

As we mentioned in our last couple of newsletters, we may be approaching a key inflexion point, crypto starting to decouple from tech stocks. For years, many in traditional finance dismissed Bitcoin as a leveraged NASDAQ proxy, and for a while, the data didn’t...

Cracks and Catalysts – Digital Vision 16

It’s been another week of heavy volatility, once again driven by the same culprit. But what’s stood out most is how resilient Bitcoin has been in the face of it all. As we discussed on our latest research call, we believe we’re at a key turning point, not just for...